Ponzi schemes in South Africa are deceptive investment scams promising high returns with minimal risk, often targeting vulnerable individuals. Operating through a simple model where early investors receive returns from new participants' funds, these schemes eventually collapse, leaving many victims financially devastated and emotionally traumatized. Understanding these schemes, their tactics, and the economic impact is crucial for empowering South Africans to make informed financial decisions and protect themselves from potential frauds.

In South Africa, where economic disparities persist, Ponzi schemes pose a significant threat to investors. These fraudulent investment opportunities promise high returns with little risk, luring unsuspecting individuals into a web of deception. This article delves into the intricacies of Ponzi schemes operating in South Africa, exploring their impact on victims and the broader implications for the country’s financial landscape. We also provide insights into preventative measures and recovery options available to those who have fallen victim to these schemes.

- Understanding Ponzi Schemes: How They Operate in South Africa

- The Impact on Investors: Financial and Emotional Consequences

- Preventative Measures and Recovery Options for Victims

Understanding Ponzi Schemes: How They Operate in South Africa

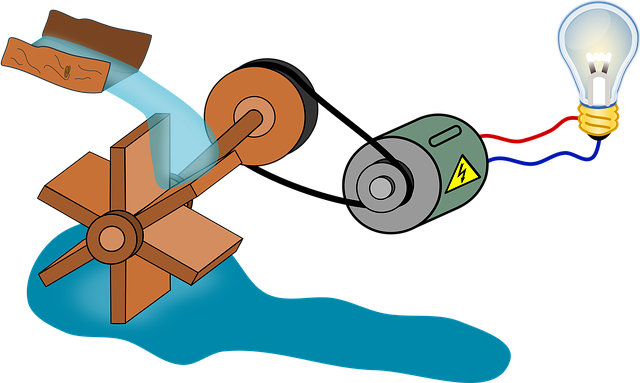

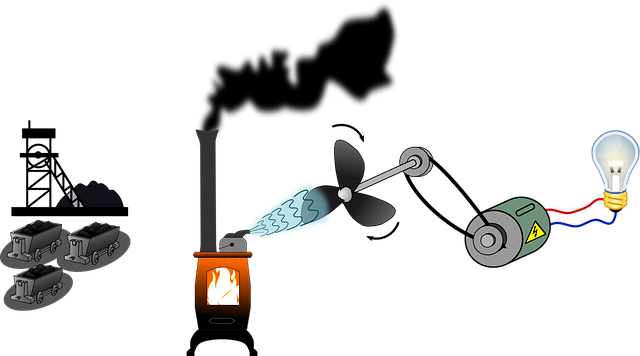

Ponzi schemes, prevalent in South Africa and worldwide, are deceptive investment scams that promise high returns with little to no risk. They operate on a simple yet insidious principle: early investors receive returns from funds contributed by subsequent investors. In South Africa, these schemes often target the vulnerable, advertising lucrative opportunities to save or grow money quickly.

The typical cycle begins when a con artist attracts initial investors, using compelling narratives and false promises of substantial gains. These returns are not generated through legitimate business activities but rather paid to early investors from funds contributed by new participants. As the scheme expands, it becomes unsustainable; eventually, there aren’t enough new investors to keep up with the promised payouts, leading to a rapid collapse, leaving many victims financially devastated.

The Impact on Investors: Financial and Emotional Consequences

When investors fall victim to a Ponzi Scheme in South Africa, the consequences can be devastating. These schemes, characterized by promises of high returns with little or no risk, lure individuals with the prospect of quick wealth. However, the reality is far from promising. Investors often find themselves in a financial quagmire, facing significant losses that can take years to recover, if at all. The initial allure of substantial returns quickly turns into emotional turmoil as investors realize they’ve been deceived. The financial impact extends beyond their savings; it can lead to debt, strained relationships, and even bankruptcy.

Emotionally, the effects are profound. Many victims experience a sense of betrayal, especially when friends or family members are involved in the scheme. The stress and anxiety associated with financial loss can lead to mental health issues such as depression and anxiety disorders. Recovering from such schemes is not merely about regaining financial stability but also rebuilding trust and confidence in investments and relationships affected by the deception.

Preventative Measures and Recovery Options for Victims

Falling victim to a Ponzi scheme can have devastating consequences for investors in South Africa, leading to significant financial losses and emotional distress. Understanding these schemes and their operational methods within the local context is crucial to safeguarding against them. By recognizing the signs and taking preventative measures, investors can protect their hard-earned money. Moreover, knowledge of recovery options available for victims can provide a glimmer of hope in what might seem like an impossible situation. Staying informed and proactive is key to avoiding the traps of Ponzi Schemes in South Africa.