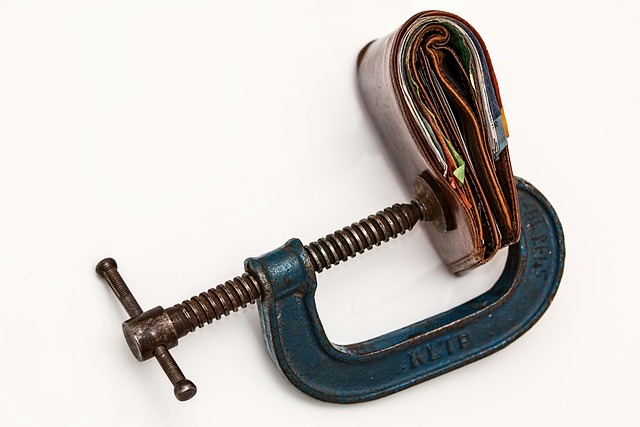

Ponzi Schemes In South Africa pose a significant financial risk, leveraging high returns promises to attract investors. These schemes operate by using new investor funds to pay existing ones, creating a deceptive facade. With economic challenges like high unemployment and income inequality exacerbating the issue, they exploit regulatory gaps and financial literacy shortcomings. To protect yourself, be wary of high-return investments with little risk, conduct thorough research, diversify your portfolio, avoid urgent decisions, and report suspicious activities.

“Unveiling the insidious rise of Ponzi schemes in South Africa: A comprehensive guide. This article explores the intricate web of these fraudulent investments, offering a clear breakdown for easy understanding. We delve into the unique factors fueling their growth within the South African context and equip readers with crucial knowledge to recognize and avoid such schemes. By staying informed, you can protect yourself and contribute to preventing this harmful financial trend.”

- Understanding Ponzi Schemes: A Simple Breakdown

- The South African Context: Factors Enabling Scheme Growth

- Protecting Yourself: Recognizing and Avoiding Ponzi Schemes

Understanding Ponzi Schemes: A Simple Breakdown

A Ponzi scheme is an investment fraud that promises high returns with little or no risk, but instead of generating profits through legitimate means, it pays existing investors using funds from new investors. This deceptive practice has unfortunately gained traction in South Africa, leading to significant financial losses for many unsuspecting individuals. These schemes often attract people with their seemingly guaranteed returns and the promise of quick wealth.

At its core, a Ponzi scheme relies on a constant influx of new investors to maintain the illusion of success. The operator uses the money from newer investors to pay older ones, creating a false sense of security and growth. However, without actual investment returns or productive use of funds, these schemes are unsustainable and eventually collapse, leaving behind disappointed and defrauded investors. Understanding this basic structure is crucial in recognizing and avoiding Ponzi Schemes In South Africa.

The South African Context: Factors Enabling Scheme Growth

In recent years, Ponzi Schemes in South Africa have emerged as a significant concern for investors and financial regulators alike. Despite being illegal, these schemes continue to thrive due to a combination of factors unique to the South African context. One of the primary enablers is the country’s economic landscape, characterized by high unemployment rates and income inequality. Many individuals are desperate for investment opportunities promising substantial returns, even if those claims seem too good to be true. This vulnerability opens doors for Ponzi Scheme operators who target unsophisticated investors with elaborate but false promises.

Additionally, South Africa’s regulatory environment faces challenges in keeping pace with the evolving nature of these scams. Weak enforcement and a lack of financial literacy among the population create an ideal breeding ground for Ponzi Schemes in South Africa. The schemes often operate under the radar, taking advantage of regulatory loopholes and the complex nature of modern investment products. As a result, investors are left vulnerable, facing significant financial losses when these fraudulent operations eventually collapse.

Protecting Yourself: Recognizing and Avoiding Ponzi Schemes

Protecting yourself from Ponzi schemes in South Africa involves being vigilant and informed. These fraudulent investments often promise high returns with little or no risk, which is a red flag. They may operate through complex structures or use attractive marketing strategies to lure unsuspecting individuals. To avoid becoming a victim, always conduct thorough research on any investment opportunity that seems too good to be true. Check the credibility of the company and its track record; if it’s new, ask for evidence of past performance. Diversify your investments and never invest money you can’t afford to lose. Be wary of high-pressure sales tactics or promises of quick returns. Remember, legitimate businesses build over time, and real opportunities rarely require urgent action.

If an investment opportunity sounds suspect, don’t hesitate to reach out to regulatory bodies like the Financial Sector Conduct Authority (FSCA) in South Africa for guidance. They provide resources to help citizens identify and avoid Ponzi schemes. Reporting suspicious activities is also crucial; it can protect others from potential harm. Stay informed about ongoing scams by subscribing to official alerts and advice, ensuring you’re always one step ahead of these deceptive practices known as Ponzi Schemes In South Africa.

In conclusion, the rise of Ponzi schemes in South Africa highlights the need for financial literacy and vigilance. By understanding how these deceptive investments operate, recognizing red flags, and staying informed about local market trends, individuals can protect themselves from falling victim to such scams. Being proactive in educating oneself and seeking professional advice is crucial in navigating the complex financial landscape, especially in the face of ever-evolving fraudulent activities like Ponzi schemes in South Africa.