Ponzi schemes in South Africa have evolved into sophisticated operations targeting vulnerable populations, particularly those facing economic hardships or lacking financial literacy. Scammers promise high returns with minimal risk using digital platforms and personalized pitches to build trust. These schemes often collapse when new investors dry up, leaving victims with substantial losses. Recognizing tactics like urgency, exclusivity, and initial small returns is key to avoiding these scams. South Africa has seen multiple high-profile cases, underscoring the persuasive nature of these deceptive investments. Protecting oneself requires vigilance, critical thinking, and thorough research, avoiding emotional appeals and urgent action pressure. Consulting trusted financial advisors is essential before investing.

In the intricate web of financial fraud, Ponzi schemes stand as insidious traps, luring vulnerable individuals in South Africa with promises of unprecedented returns. These schemers exploit trust and ambition, orchestrating targeted scams that have left many reeling. This article delves into the global phenomenon of Ponzi schemes, shedding light on their rising prevalence in South Africa, the tactics employed by fraudsters, and crucial strategies for protection. Understanding these schemes is key to safeguarding against financial losses in a landscape where cunning scammers proliferate.

- Understanding Ponzi Schemes: A Definition and Their Global Impact

- The Rise of Targeted Scams in South Africa: Who is at Risk?

- Unveiling Common Ponzi Scheme Tactics Used by Fraudsters

- Real-World Examples: High-Profile Ponzi Cases in South Africa

- Protecting Yourself: Strategies for Recognizing and Avoiding Ponzi Schemes

Understanding Ponzi Schemes: A Definition and Their Global Impact

Ponzi schemes are a type of investment fraud that has been plaguing both developed and developing countries, including South Africa. At their core, they promise high returns with little or no risk to investors, often targeting vulnerable individuals who are seeking financial stability or significant wealth accumulation. In reality, these schemes operate on the money contributed by new investors, rather than through any genuine business activity or investment strategy.

Globally, Ponzi schemes have had devastating effects, leading to massive financial losses for thousands of people. They create a false sense of security and can cause widespread panic when their unsustainable nature is eventually revealed. In South Africa, where economic inequality remains a persistent challenge, Ponzi schemes often find fertile ground among those seeking quick wealth or desperate for stable income streams. Understanding the mechanics of these schemes is crucial in order to protect individuals from becoming victims and to foster financial literacy across communities.

The Rise of Targeted Scams in South Africa: Who is at Risk?

In recent years, Ponzi Schemes in South Africa have become increasingly sophisticated and targeted, preying on vulnerable individuals looking for financial security or quick gains. These schemes often masquerade as legitimate investment opportunities, taking advantage of a growing desire for alternative income streams and promises of high returns with little risk. With the rise of digital platforms and social media, scammers have found new ways to reach their targets, making it easier than ever to spread deceptive messages on a large scale.

High-risk groups include the elderly, low-income earners, and those unfamiliar with financial investments. Scammers target these individuals by leveraging trust, offering personalized pitches, and using compelling narratives to lure them in. The promise of substantial returns or guaranteed wealth is particularly attractive to those facing financial hardships or lacking access to traditional banking services. However, as soon as new investors are brought on board, the scheme relies on a constant influx of fresh cash from new victims to maintain its facade, ultimately leaving many individuals with significant losses and no recourse.

Unveiling Common Ponzi Scheme Tactics Used by Fraudsters

In the world of Ponzi Schemes in South Africa, fraudsters employ cunning tactics to lure vulnerable individuals with promises of incredible returns on investments. One of the most common strategies is the use of high-pressure sales techniques, where con artists create a sense of urgency and exclusivity, convincing victims that they are part of a special opportunity. They often target older adults or those with limited financial literacy, preying on their desire for security and quick wealth.

Another tactic involves the use of false testimonials and fabricated success stories. Fraudsters may claim to have created a revolutionary investment model or discovered a secret strategy, attracting curious individuals looking for an edge in the market. They might also offer initial small ‘returns’ to build trust and encourage further investment, forming a cycle of deception that ultimately collapses when new funds dry up. Recognizing these tactics is crucial in navigating the complex landscape of Ponzi Schemes in South Africa and protecting oneself from becoming a victim.

Real-World Examples: High-Profile Ponzi Cases in South Africa

In recent years, South Africa has witnessed several high-profile cases of Ponzi schemes that have left a trail of devastation in their wake. One notable example is the scheme orchestrated by a well-known entrepreneur who promised investors astronomical returns on their investments. The allure of quick and substantial profits drew many individuals, particularly those facing financial hardships or seeking alternative investment opportunities. However, as the scheme unraveled, it became apparent that it was a classic Ponzi structure—paying existing investors with money from new ones, rather than genuine profits. This fraud resulted in significant losses for countless victims, highlighting the insidious nature of these schemes.

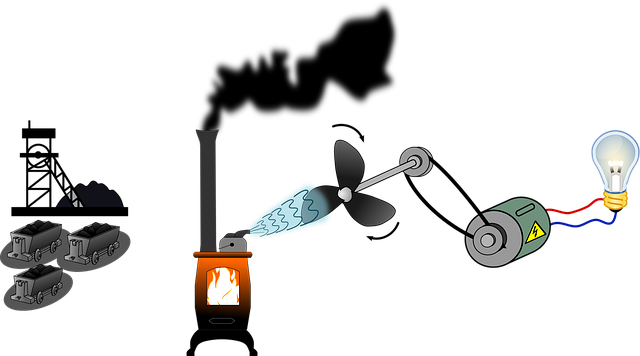

Another case involved a non-profit organization claiming to invest in sustainable energy projects. It attracted donations and investments by positioning itself as an ethical and environmentally conscious alternative to traditional banking. Unsuspecting donors were promised substantial returns over time, but instead, the funds disappeared, and the organization vanished without a trace. These real-world examples serve as a stark reminder of how sophisticated and persuasive Ponzi schemes can be in targeting vulnerable individuals within South Africa’s financial landscape.

Protecting Yourself: Strategies for Recognizing and Avoiding Ponzi Schemes

Protecting yourself from Ponzi schemes in South Africa requires a keen eye and critical thinking. These fraudulent investment opportunities often target vulnerable individuals promising high returns with little risk. To avoid becoming a victim, it’s crucial to verify the legitimacy of any investment opportunity that seems too good to be true. Look for signs such as unrealistic guarantees, lack of transparency, or pressure to act quickly.

Researching the company or individual behind the scheme is essential. Check their track record and whether they are registered with relevant financial authorities. Be wary of emotional appeals or high-pressure sales tactics. Remember, legitimate investments take time and due diligence. Always seek advice from trusted financial advisors and never invest based solely on promises of substantial returns without proportional risk.

Ponzi Schemes in South Africa pose a significant threat to vulnerable individuals, preying on their trust and financial desperation. By understanding these schemes, recognizing common tactics, and adopting protective strategies, citizens can safeguard themselves from becoming the next victim. Staying informed and vigilant is key to breaking the cycle of these fraudulent operations and ensuring a safer financial environment for all.