Ponzi schemes, prevalent globally and particularly harmful in South Africa, prey on investors with promises of easy returns. These fraudulent systems pay early investors with funds from later contributors, creating a false sense of success. Once new investments dry up, the scheme collapses, leaving victims with significant losses and emotional trauma. To protect oneself, South Africans should stay informed, conduct thorough research, diversify investments, and consult regulated financial advisors. Regulatory bodies like the FSCA are stepping up efforts to combat these schemes through heightened scrutiny, market audits, and fraud investigations. By adopting a cautious investing strategy, individuals can significantly reduce their risk of becoming victims.

“In the world of investment, Ponzi schemes stand as insidious scams that have costed South African (SA) investors millions. These elaborate frauds, characterized by the promise of easy and unrealistic returns, have become a growing concern in SA. This article delves into the intricacies of Ponzi Schemes in South Africa, exploring their prevalence, how they operate, and their devastating impact on investors. We also dissect regulatory efforts to combat these schemes and equip readers with strategies to protect themselves from common scams.”

- Understanding Ponzi Schemes: Unveiling the Illusion of Easy Returns

- The Prevalence of Ponzi Schemes in South Africa: A Growing Concern

- How These Scams Operate: Recognizing Red Flags

- Impact on Investors: Financial and Psychological Consequences

- Regulatory Efforts to Combat Ponzi Schemes in SA

- Protecting Yourself: Strategies for Avoiding Common Scams

Understanding Ponzi Schemes: Unveiling the Illusion of Easy Returns

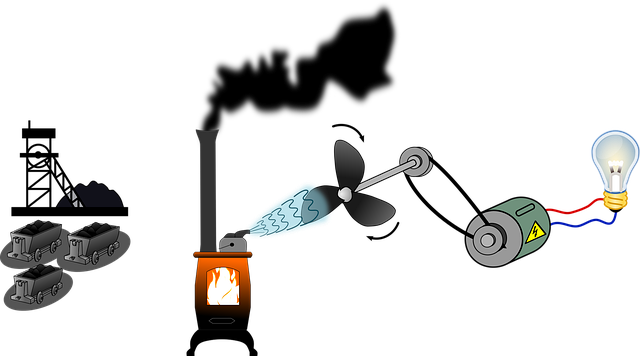

Ponzi Schemes, prevalent in the global financial landscape, have also found their way into South Africa, tricking unsuspecting investors with promises of easy and substantial returns. At their core, these schemes operate on a simple but insidious principle: early investors are paid returns from funds contributed by later investors. This creates an illusion of profitability, luring more individuals to invest, which in turn fuels the scheme. However, the reality is far from sustainable; it’s a house of cards built on the back of new money inflows. Once these influxes dry up, the entire structure collapses, leaving many investors with significant losses.

Understanding how Ponzi Schemes operate is crucial for South African investors to avoid becoming victims. The schemers often employ sophisticated marketing strategies, leveraging social media and word-of-mouth to spread their illusions of easy wealth. They may also target specific demographics or offer seemingly unique investment opportunities. Investors need to be vigilant, conduct thorough research, and seek professional advice before committing their hard-earned money. By staying informed and being cautious, individuals can protect themselves from these fraudulent schemes that have cost many South Africans millions.

The Prevalence of Ponzi Schemes in South Africa: A Growing Concern

In recent years, Ponzi Schemes in South Africa have emerged as a significant and growing concern for investors. These fraudulent investment schemes, which promise high returns with little or no risk, have duped countless individuals across the country, costing them millions of rands. With sophisticated marketing strategies and enticing promises, these schemes often target vulnerable populations, including retirees and small business owners, who are seeking stable investments to secure their financial future.

The prevalence of Ponzi Schemes In South Africa highlights a concerning trend in the country’s investment landscape. Scammers have exploited the lack of financial literacy and regulatory gaps to create intricate frauds that can take years to unravel. As such, there is an urgent need for increased public awareness, stringent regulatory oversight, and robust educational initiatives to protect investors from these insidious schemes.

How These Scams Operate: Recognizing Red Flags

Ponzi schemes, a fraudulent investment scam, have sadly become all too common in South Africa, costing investors millions of rand. These schemes operate by promising high returns with little to no risk, attracting unsuspecting individuals looking for financial gains. The ‘investor’ funds are used to pay off earlier participants, creating the illusion of success and encouraging more people to invest. However, this is a house of cards; without new investors, the scheme collapses, leaving behind furious and financially harmed victims.

Recognizing these red flags is crucial in avoiding such scams: excessive promises of high returns, lack of regulatory oversight or transparent financial reporting, constant pressure to act quickly, and unverifiable success stories. If an opportunity seems too good to be true, it probably is. Always conduct thorough research and consult with regulated financial advisors before investing your hard-earned money.

Impact on Investors: Financial and Psychological Consequences

The impact of Ponzi schemes on investors in South Africa is profound, extending beyond mere financial losses to deep psychological consequences. When investors fall victim to these fraudulent investments, they often experience a sense of betrayal and loss of trust, not just in the scammer but also in the broader financial system. This emotional turmoil can be devastating, leading to increased stress, anxiety, and even depression.

Financially, the effects are equally damaging. Investors stand to lose substantial amounts of money, which can lead to a cascade of issues, including difficulty meeting financial obligations, strained relationships, and a decline in overall quality of life. Many investors, particularly those who have dedicated their savings or retired funds to these schemes, may find themselves pushed into dire financial circumstances, highlighting the severe economic impact of Ponzi Schemes in South Africa.

Regulatory Efforts to Combat Ponzi Schemes in SA

In an attempt to combat the growing prevalence of Ponzi Schemes in South Africa, regulatory bodies have intensified their efforts. The Financial Sector Conduct Authority (FSCA) plays a pivotal role in monitoring and enforcing regulations that aim to protect investors from these fraudulent schemes. They actively collaborate with law enforcement agencies to investigate and prosecute culprits behind Ponzi operations. The FSCA’s strategies involve increased scrutiny of investment opportunities, particularly those promising high returns with little risk. Regular audits and market surveillance help identify suspicious activities and potential scams.

The South African government has also implemented various measures to educate investors about the dangers of Ponzi Schemes. Awareness campaigns highlight the red flags and signs of fraudulent investments, empowering individuals to make informed decisions. Additionally, amendments to existing laws and regulations have been made to close loopholes exploited by scammers, further fortifying the regulatory framework against Ponzi Schemes in the country.

Protecting Yourself: Strategies for Avoiding Common Scams

Protecting yourself from Ponzi schemes in South Africa requires a combination of caution and knowledge. Always verify the legitimacy of investment opportunities, especially those promising high returns with little to no risk. Research the company or individual thoroughly; check their credentials, track record, and any regulatory warnings or sanctions. Be wary of pressure tactics or promises of quick, guaranteed profits—red flags often signal potential scams. Diversify your investments across various sectors and assets to reduce the impact if one turns out to be fraudulent.

Stay informed about common Ponzi scheme tactics by keeping up with financial news and consumer protection alerts. Regularly review your investments and seek advice from reputable financial advisors or regulators if you suspect foul play. Remember, if it sounds too good to be true, it probably is. By staying vigilant and adopting a measured approach to investing, you can significantly lower the risk of falling victim to Ponzi schemes in South Africa.

Ponzi Schemes in South Africa pose a significant threat to investors, preying on their desire for easy returns. Understanding these schemes and recognizing red flags are essential steps towards protecting oneself from financial loss. As the regulatory landscape evolves, staying informed and adopting proactive strategies can help mitigate risks associated with these scams, ensuring investors’ peace of mind and safeguarding their hard-earned money.